Fiscally

Responsible

Outcomes and Economic

Growth

Strategy

Economic Outlook and Review

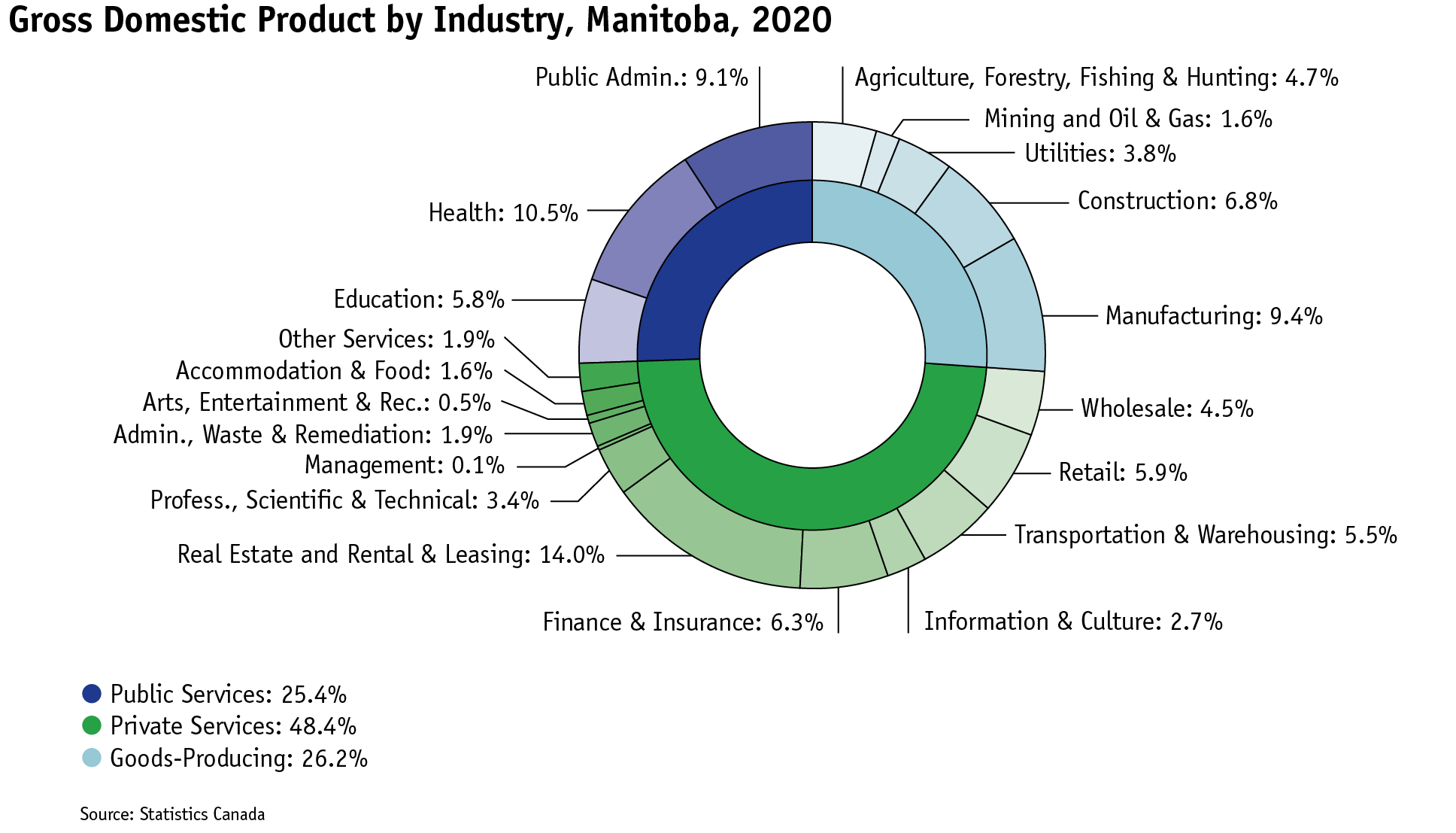

Manitoba has one of the most diverse and balanced economies in Canada. Its economy is made up of a variety of economic industries, with the goods-producing sector generating 26 per cent of provincial gross domestic product (GDP) and private and public services accounting for a combined 74 per cent.Ten industries contribute five per cent or more to total provincial GDP. Historically, a decline in one area of the economy is offset by growth elsewhere, demonstrating the provincial economy’s resiliency to downturns. A diverse economy is a protected economy.

Economic Outlook

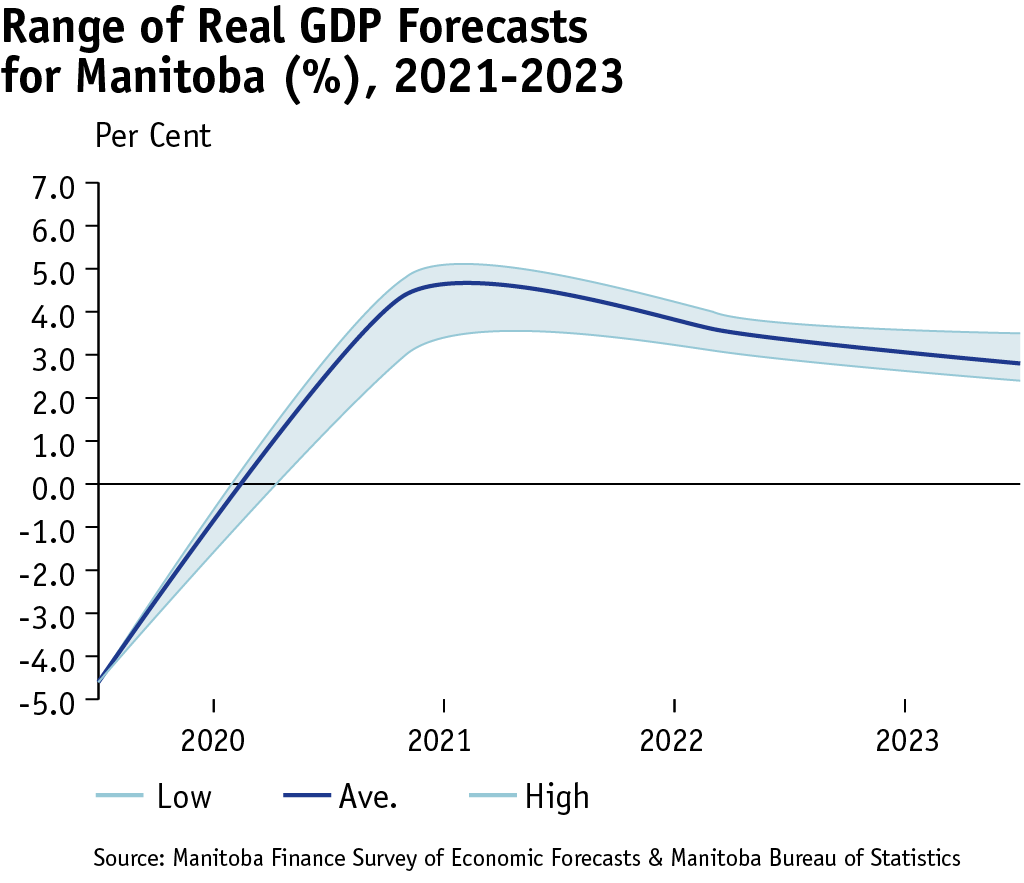

Building on the recovery in 2021, the Manitoba economy is expected to continue the upwards trajectory with real GDP expanding by 3.6 per cent in 2022 and 2.8 per cent in 2023.High prices for Manitoba commodities such as wheat, canola, minerals, and petroleum are expected to remain elevated in 2022 after a record year for provincial exports in 2021. Additional food manufacturing production capacity scheduled to come online in 2022 should also bolster provincial economic activity.

The provincial labour market has recovered from the declines in 2020 with total employment surpassing pre-pandemic levels in late 2021. Manitoba’s unemployment rate is projected to remain one of the lowest in the country at 5.2 per cent in 2022 before declining further to 5.0 per cent in 2023.

Programs to support employment during the pandemic have included the Manitoba Youth Jobs Program, the Urban and Hometown Green Team Program and the Manitoba Parks Green Team Program, the Manitoba Pandemic Sick Leave Program, the Healthy Hire Manitoba Program and the Sector Support Program.

Strong income gains in 2021 translated to healthy growth in consumer spending and larger than anticipated government revenues. The upward trajectory in consumer spending should continue into 2022 as public health restrictions are gradually lifted, and Manitobans spend part of their $5 billion savings accumulated during the pandemic.

New international migrants recruited under the auspices of the Provincial Nominee Program will help spur population growth, provide relief to Manitoba’s tight labour market, and further contribute to already strong consumer spending. In 2021, Manitoba issued over 10,000 nominee program invitations. The provincial population is projected to increase by 0.9 per cent in 2022 and 1.0 per cent in 2023.

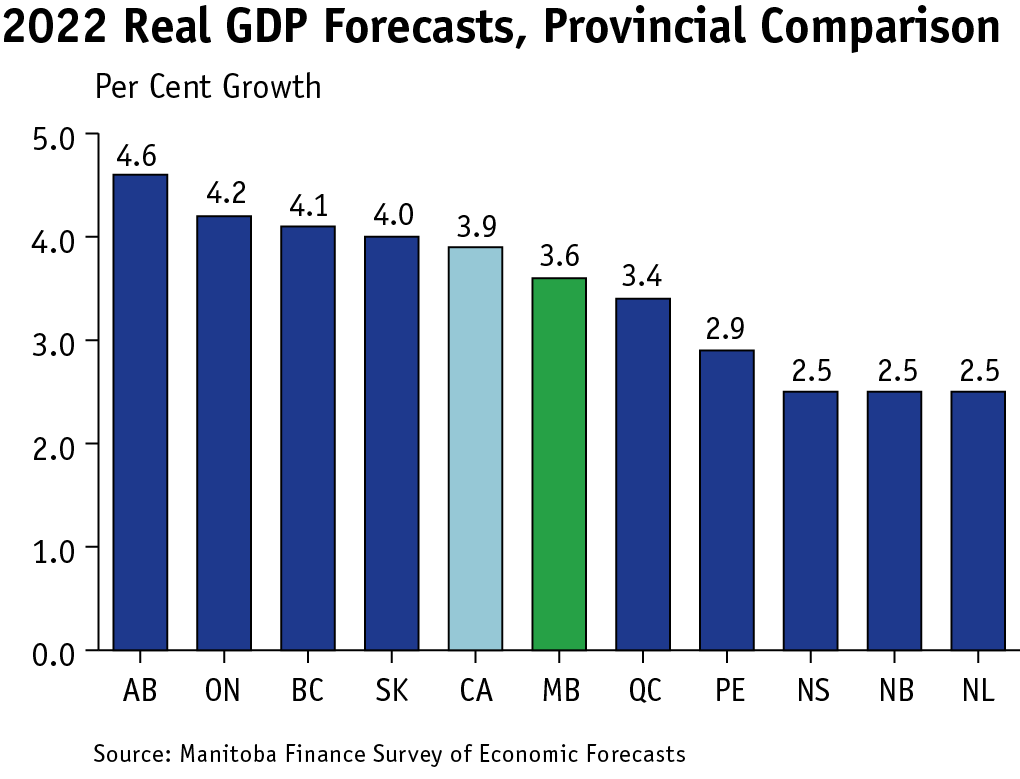

Overall, the economic growth forecast for Manitoba ranks fifth among provinces.

|

Manitoba Economic Outlook at a Glance |

||

|

2022F |

2023F |

|

|

Gross Domestic Product |

||

|

Real |

3.6 |

2.8 |

|

Nominal |

5.8 |

4.4 |

|

Consumer Price Index |

3.9 |

2.5 |

|

Employment |

2.3 |

1.2 |

|

Unemployment Rate (%) |

5.2 |

5.0 |

|

Population Growth Rate (%) |

0.9 |

1.0 |

|

per cent change unless otherwise noted Source: Manitoba Finance Survey of Economic Forecasts & Manitoba Bureau of Statistics |

||

While demand for goods and services is expected to remain robust in 2022, supply chain disruptions, labour market dislocations, rising consumer prices, and future COVID-19 strains present downside risks to the provincial outlook.

Risks to the Manitoba outlook

The following factors present downside risks that could potentially decelerate the post-pandemic recovery in the province.

COVID-19

The pandemic’s grip on global economies is expected to loosen in the coming years as vaccine uptake improves and previous encounters with the virus provide some protection from reinfection. The emergence and spread of a novel COVID-19 variant that has the ability to evade vaccine defenses could be a setback to the impressive economic recovery around the world, especially in high-income countries.

Supply chains

Global supply chain disruptions are a main reason for the rising prices that consumers are experiencing. Although these constraints are anticipated to relax in 2022 as firms ramp up production, an unexpected development such as the emergence of a new COVID-19 variant of concern or an extreme weather event could create further supply-side challenges.

Labour shortages

Persistent labour shortages could disrupt business operations and delay the economic recovery. An insufficient supply of labour may also push up wages and add to the upwards pressure on consumer prices.

Climate risks

Climate change and extreme weather events such as droughts, flooding, and wildfires can dislocate people and communities. These events can also have a material impact on the provincial economy and finances.

In 2021, Manitoba experienced a severe drought that damaged agriculture production for several key crops and forced the early sale of livestock herds. Wheat production declined nearly 30 per cent last year to 3.75 million tonnes – the lowest production volume in seven years. The drought also affected Manitoba Hydro exports and net income.

Geopolitical instability

Russia’s invasion of Ukraine has triggered a wave of international sanctions on Russia. Although the economic impacts are expected to be greatest in Europe, the conflict could affect jurisdictions around the world by disrupting trade flows and global supply chains. Prices for oil and natural gas have already risen sharply in the wake of the invasion. Global wheat prices have also soared to historic highs. This could intensify mounting inflation on items such as fuel for vehicles and home heating and food costs.

Inflation

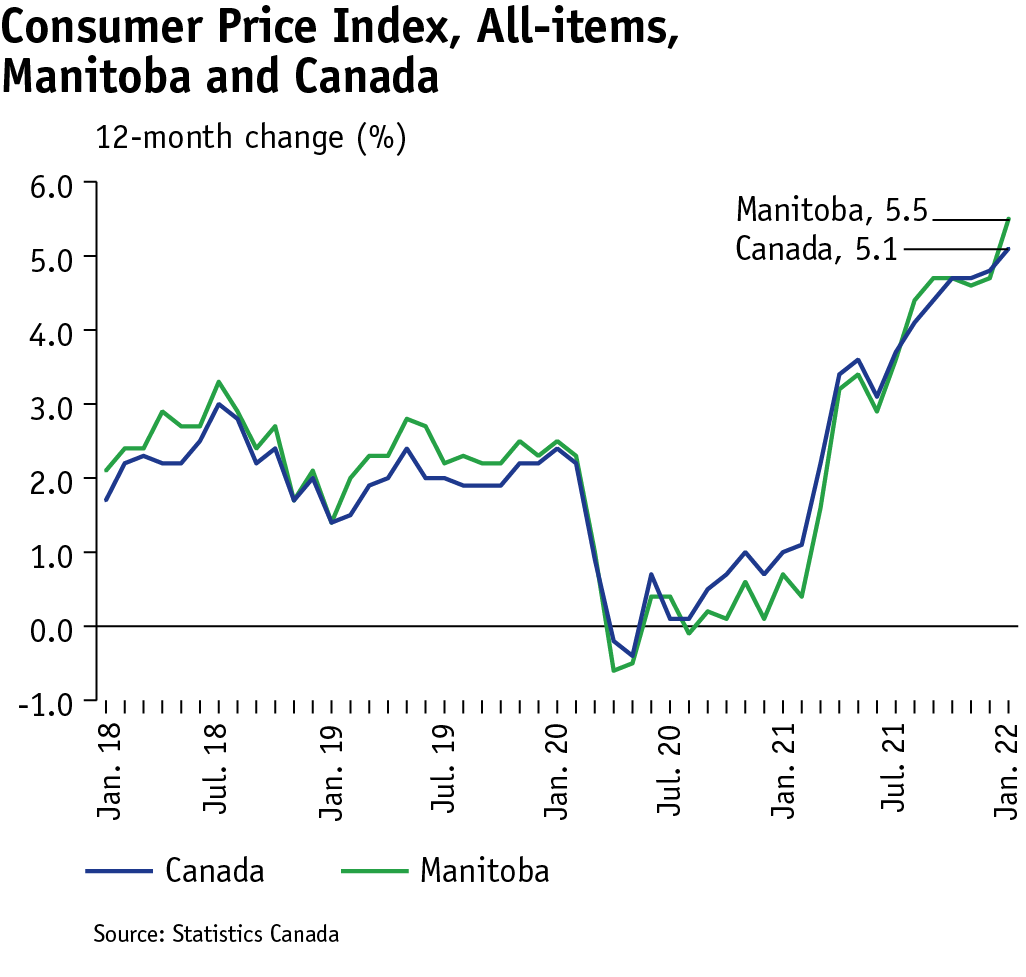

In January 2022 the year-over-year consumer price index (CPI), the Bank of Canada’s measure for inflation, rose by 5.5 per cent in Manitoba, representing the largest increase in nearly 30 years. Nationally, prices rose by 5.1 per cent.

Rising energy prices are playing a large role in the current inflationary environment across the country and globally. Manitoba’s energy prices are up 22.6 per cent relative to last year, while national energy prices are 23.1 per cent higher. The Russia-Ukraine conflict is generating additional upwards pressure on energy prices, pushing the price per barrel of oil to nearly $130 in March 2022 – nearly double the price last March. Consequentially, gas prices at the pump escalated to over $1.70 per litre in Winnipeg, representing the highest gas prices for the city on record. Overall, energy prices contributed 1.8 per cent to total provincial CPI growth in January 2022. Energy prices can also indirectly affect costs for items such as food via higher transportation costs.

Inflation is expected to continue to trend above the Bank of Canada’s target range (one to three per cent) in early 2022 before falling to the higher end of the range in mid 2022. Persistent labour shortages, unrelenting supply chain bottlenecks, future COVID-19 outbreaks, extreme weather events, and geopolitical instability could accelerate the upwards pressure on consumer prices and lead to inflation that is more enduring than projected in the provincial outlook.

Canadian Outlook

The Canadian economy continues to recover although it faces headwinds with COVID-19 variants, labour shortages, severe climate events, and global supply chain disruptions. These challenges have not halted economic recovery in Canada, merely fragmented it and delayed progress to a full recovery.

Canadian total employment levels have fully recovered, while unemployment rates are edging above their pre-pandemic levels. Labour shortages are a cause for concern as job vacancies are difficult to fill and continue to increase across the country. Throughout the pandemic, an increased importance in occupational skills has created both opportunities and challenges for employers.

Household spending patterns shifted as restrictions and other health measures evolved. Strong demand for goods outpaced the demand for services in 2021. Spending on services is expected to pick up momentum in 2022 as the pandemic transitions to the next stage.

The Manitoba Finance Survey of Economic Forecasts expects the Canadian economy to expand by 3.9 per cent in 2022 and 3.0 per cent in 2023.

The Bank of Canada is expecting inflation to remain elevated above the targeted 2 per cent through the first half of 2022 and return toward target levels in the second half. On March 2, 2022, the Bank of Canada announced their decision to increase the policy rate by 25 basis points to 0.50 per cent. The Bank of Canada had maintained the former policy rate since March 2020 to stimulate the Canadian economy throughout the pandemic. The Bank of Canada also indicated it will continue to use the monetary tools at the bank’s disposal to keep inflation expectations anchored, suggesting additional rate increases in 2022 are likely.

U.S. and International Outlook

The United States (U.S.) remains the number one destination for Manitoba exports, followed by Japan, Mexico, and China.

After decelerating to 2.3 per cent in the third quarter of 2021, economic growth in the U.S. picked up in the fourth quarter expanding by 6.9 per cent. The uptick was due to strong export growth, as well as investments in inventories. Rising consumer prices continues to be an area of concern for the U.S. economy, with inflation reaching a 39-year high in December 2021 at 7.0 per cent. Wages are also rising in the U.S. as businesses struggle to fill job vacancies.

The U.S. Congress failed to pass the Build Back Better Act that would have injected $2.2 trillion in the U.S. economy in new government spending. The unsuccessful stimulus package has caused several economic forecasting agencies to downgrade U.S. growth projections. In the recent State of the Union address, President Biden doubled down on the administration’s ‘buy American’ position, which may create challenges for Manitoba exporters.

|

International Economic Outlook |

||

|

2022F* |

2023F* |

|

|

Canada |

3.9 |

3.0 |

|

United States |

4.0 |

2.6 |

|

Japan |

3.3 |

1.8 |

|

Mexico |

2.8 |

2.7 |

|

China |

4.8 |

5.2 |

|

Global |

4.4 |

3.8 |

*real GDP growth rate (%)

Source: Manitoba Finance Survey of Economic Forecasts & International Monetary Fund

The International Monetary Fund (IMF) forecasts that the U.S. economy will grow by 4.0 per cent in 2022 and 2.6 per cent in 2023, the Japanese economy by 3.3 per cent in 2022 and 1.8 per cent in 2023, the Mexican economy by 2.8 per cent in 2022 and 2.7 per cent in 2023, the Chinese economy by 4.8 per cent in 2022 and 5.2 per cent in 2023, and the global economy by 4.4 per cent in 2022 and 3.8 per cent in 2023.

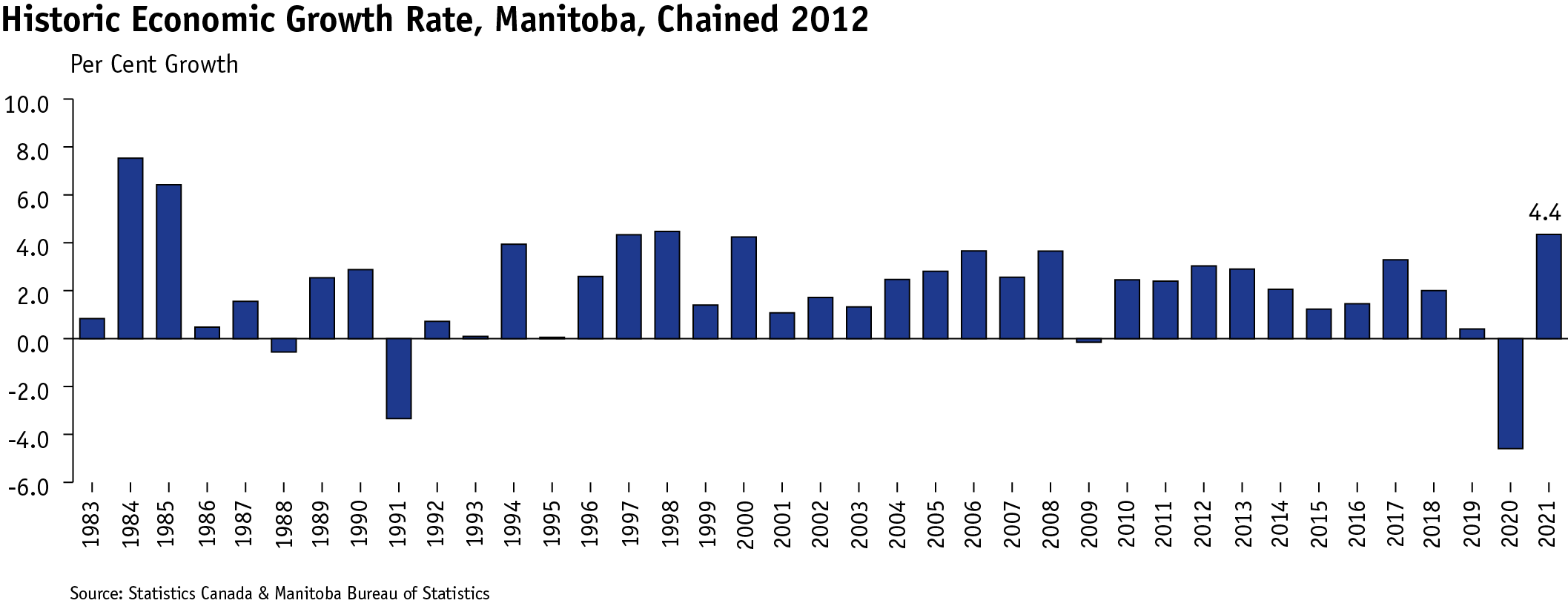

Economic Review

With a smaller economic decline in 2020, the Manitoba recovery had less ground to cover in 2021 compared to other jurisdictions. The provincial economic recovery had a slow start at the beginning of 2021 as the province was still in the grips of the second wave of the COVID-19 pandemic.As vaccination uptake accelerated and daily case counts receded, the economy gradually reopened under Manitoba’s 4-3-2-One Great Summer plan. The majority of businesses were able to resume operations and employees returned to work safely.

The emergence of the delta variant in late April 2021 and subsequent omicron variant in December 2021 decelerated the speed of the provincial economic recovery. Supply chain disruptions aggravated by the pandemic further hampered recovery efforts. Despite the pandemic-related obstacles, the provincial economy proved to be resilient in 2021 recording strong growth in a number of key areas, including:

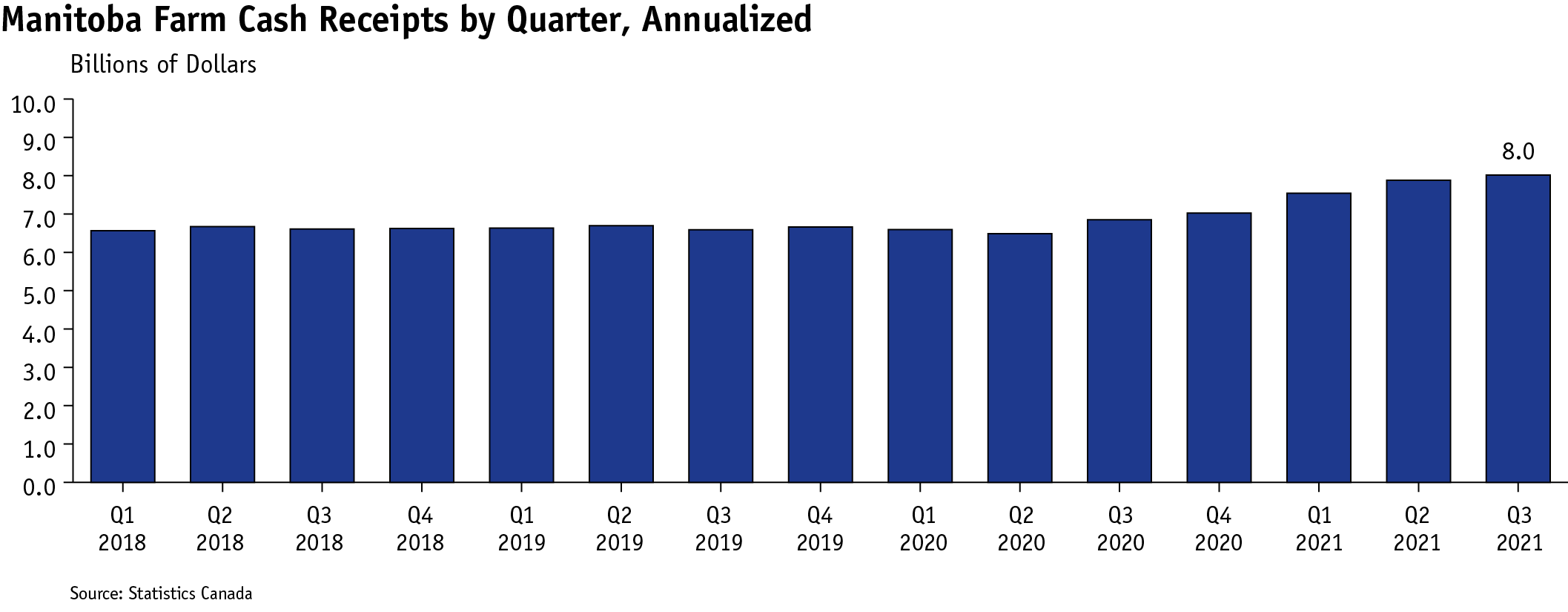

- the second lowest annual unemployment rate in the country at 6.4 per cent

- record-setting retail sales totalling $24.1 billion

- the largest farm cash receipts in history beating last year’s record by over $1.3 billion. Farm cash receipts annual growth ranks first in the country at 19.3 per cent

- record-breaking manufacturing sales eclipsing the $20.0 billion mark for the first time in Manitoba’s history

- gaining over 55,000 full-time jobs since the pandemic low to set a new annual high at 532,100

The below figure shows the annual percentage change in several key macroeconomic indicators in 2021. Across the board, the economic indicators experienced healthy growth, underscoring the strength of the provincial economic recovery.

![]()

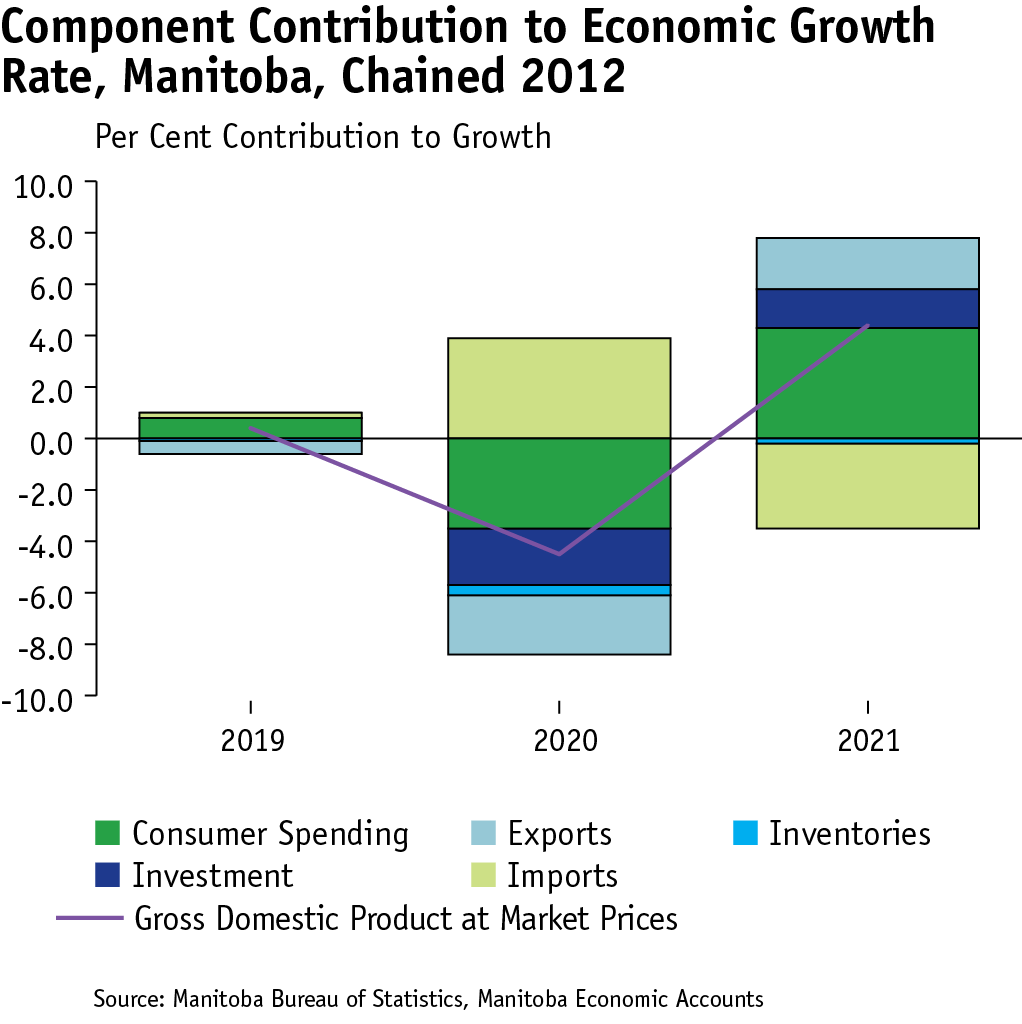

Preliminary estimates from the Manitoba Bureau of Statistics reveal the magnitude of the provincial economic rebound in 2021. Provincial real gross domestic product (GDP) expanded by 4.4 per cent in 2021 – the largest real growth rate in over twenty years.

The most influential economic components underpinning Manitoba’s growth are household spending (6.5 per cent), investment in residential structures (11.5 per cent), and record-setting interprovincial exports (+8.8 per cent). Manitoba nominal GDP, the economic indicator that informs several fiscal projections, expanded by 10.4 per cent. This growth represents that largest annual economic expansion in the province in over three decades.

Manitoba Agriculture

The 2021 crop production season was marked by severe dryness. Yields declined considerably compared to the previous five-year average. Canola yields declined 28 per cent, wheat 22 per cent, soybeans 28 per cent, and oats were down by 37 per cent. Few regions in the province experienced sufficient precipitation to harvest average production levels.

For those producers whose harvest was not drastically reduced, higher prices did help offset the production shortfall. Prices for most crops moved upwards by between 40 and 80 per cent after harvest.

Looking forward into 2022, global demand for crops is likely to remain strong until new crop supplies arrive in late summer. With less production in 2021, Manitoba producers will have smaller inventories during the first half of 2022 to draw from. Healthy snowfall during the winter months has renewed optimism that sufficient moisture supplies will be available for a good start to the 2022 production season.

Livestock receipts will likely moderate in 2022 due to a projected decline in hog prices from the record highs of 2021. Cattle prices, on the other hand, should increase as the North American herd experiences contraction.

Manitoba Minerals and Crude

After successive years of declines due to unfavourable global market conditions, commodity prices for minerals and crude oil began to rebound in the second half of 2020. In 2021, prices continued to increase for crude oil, copper, zinc and nickel by 37.4 per cent, 17 per cent, 12.2 per cent and 8.5 per cent, respectively. Slight declines occurred with gold and silver of 5 per cent and 10.4 per cent.

With higher prices for several Manitoba minerals, capital expenditures for the mining, quarrying, and oil and gas extraction sector increased to $612 million in 2021, a 5.0 per cent increase over 2019 investment levels. In October 2021, the New Britannia gold mill officially came online, adding gold production capacity and jobs to the Snow Lake region.

The minerals and crude outlook for 2022 is bright. Mineral and oil prices are expected to remain elevated due to metal production constraints in Europe and strong consumer demand in North America, as the recovery from COVID-19 continues as well as the growing push towards decarbonization.

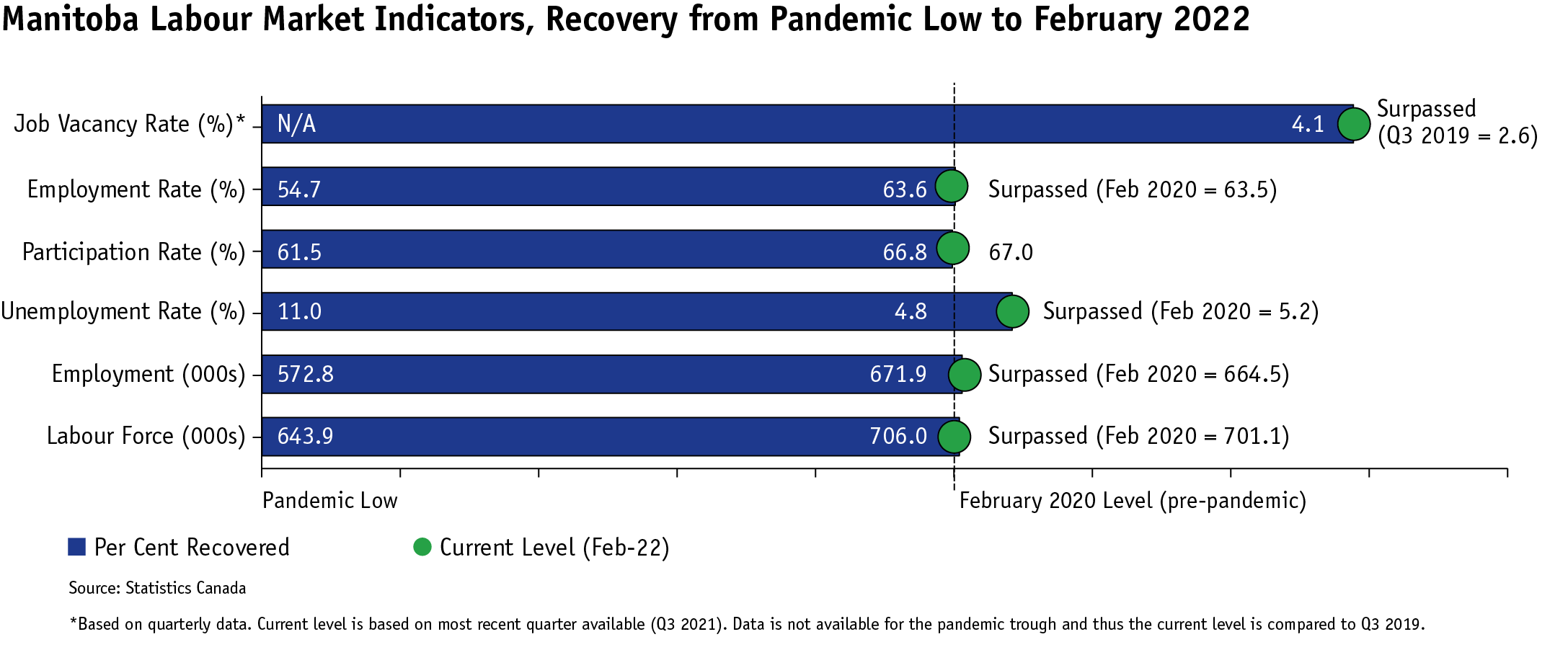

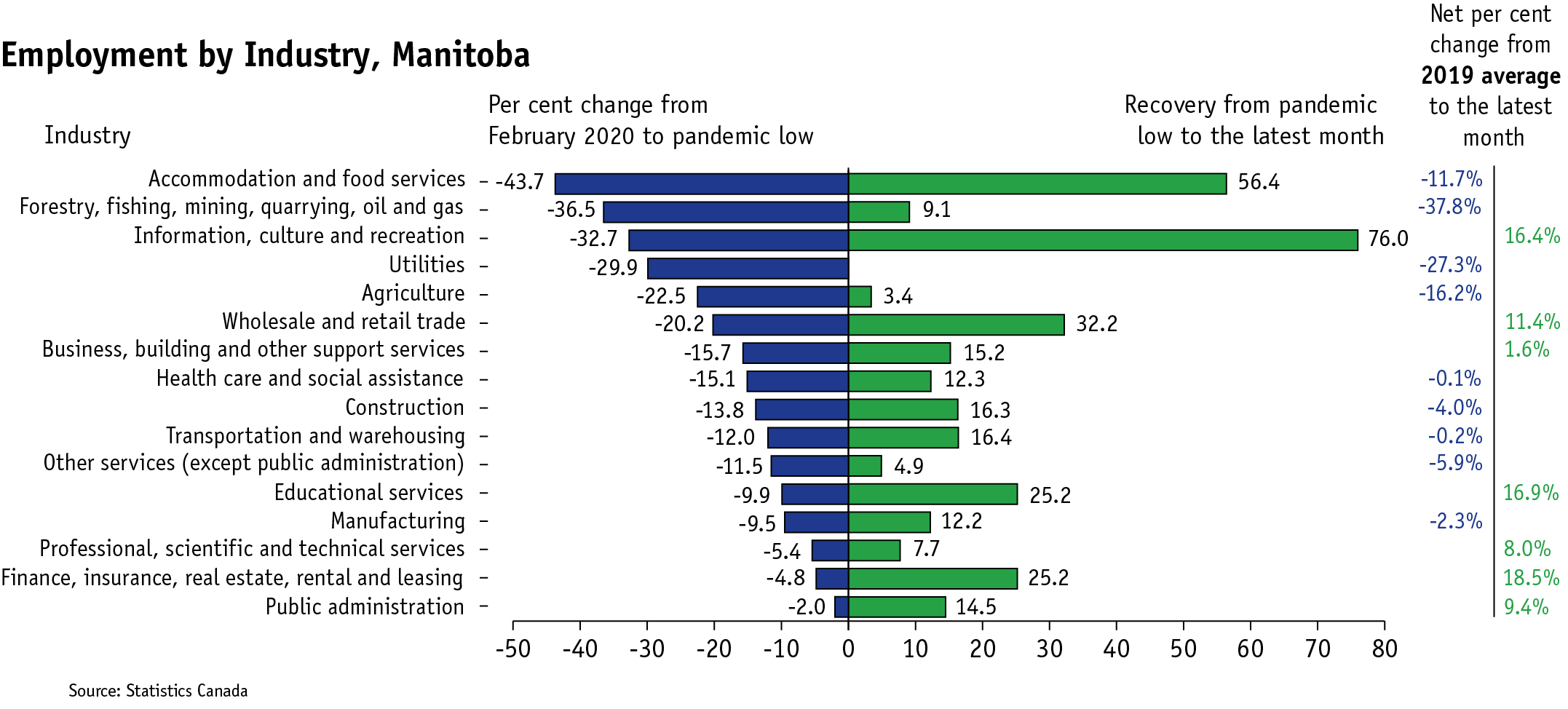

Labour Market

Manitoba’s labour market has shown exceptional resiliency throughout the course of the pandemic. After losing 91,700 jobs during the first wave of the pandemic, Manitoba employment surpassed the pre-pandemic level for the first time in December 2021. As of February 2022, Manitoba has regained 99,100 jobs.

Manitoba’s overall unemployment rate is currently

4.8 per cent – the third lowest in the country. The

youth unemployment rate is also the third lowest in the country – more than 2 percentage points below the national average. Manitoba’s female unemployment rate is 4.3 per cent, ranking second lowest.

The strength of the provincial labour market recovery is further evident in the key labour market indicators chart below. Several indicators, including the labour force size, number of employed Manitobans, and the unemployment and employment rates, have fully recovered and exceeded pre-pandemic levels recorded in February 2020. Meanwhile, the participation rate is nearing pre-pandemic levels with little ground left to recover.

|

Labour Market

|

Manitoba

|

National Average |

Manitoba&aposs Rank

|

|

Manitoba Unemployment Rate |

4.8% |

5.5% |

3rd Lowest |

|

Youth Unemployment Rate |

8.7% |

10.9% |

3rd Lowest |

|

Female Unemployment Rate |

4.3% |

5.3% |

2nd Lowest |

Source: Statistics Canada

Despite strong gains over the past year, the labour market recovery remains uneven in Manitoba and other jurisdictions. Employment in sectors that were operating at reduced capacity, such as accommodation and food services, remain below pre-pandemic levels. With COVID-19 hospitalization counts declining to manageable levels and Manitoba ending all pandemic restrictions effective March 15, 2022, employment in affected industries is expected to accelerate going forward.

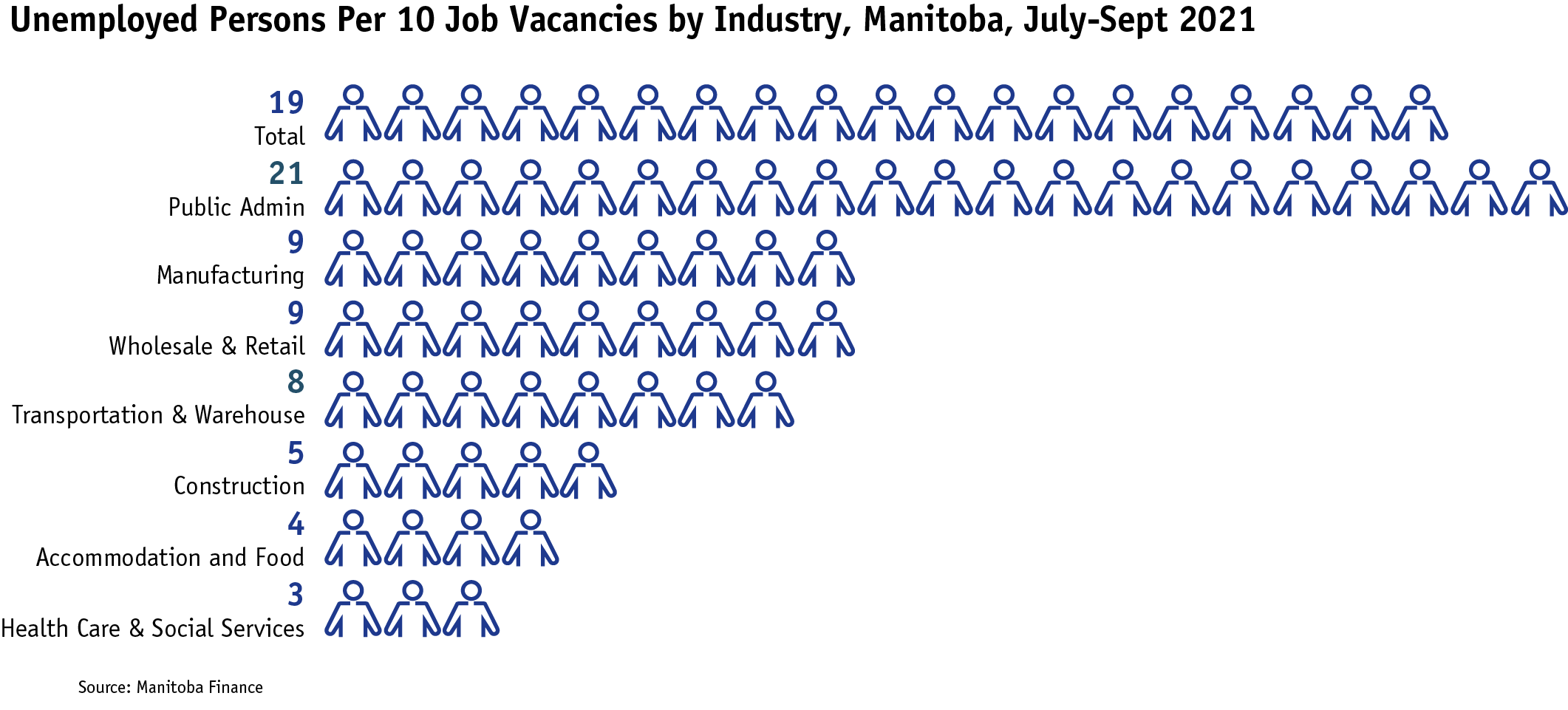

The pandemic and subsequent recovery has disrupted the supply and demand for labour in the economy. Local businesses resuming operations are reporting challenges filling vacant positions. Labour shortages are not unique to Manitoba, however. A recent Bank of Canada survey found that nearly three quarters of businesses are experiencing intensifying labour shortages.

The chart below shows the extent of labour shortages in Manitoba. In several economic sectors, the number of job vacancies exceeds the pool of unemployed persons available. For example, there are four unemployed persons for every ten job vacancies in the accommodation and food services sector. The total provincial labour market shows nineteen unemployed persons per ten job vacancies.

Persistent labour shortages can suppress economic development. Businesses that are unable to find employees to fill vacant positions may be unable to expand operations in the short term. Less economic growth means less tax revenue for government programs and services.

Manitoba will undertake the following actions as first steps to address growing labour shortage concerns:

- increase investments in education and training under the Skills, Talent, and Knowledge Strategy

- maximize the number of new skilled people entering the province under the provincial nominee program

- create safe and affordable child care spaces under the Early Learning and Child Care Agreement

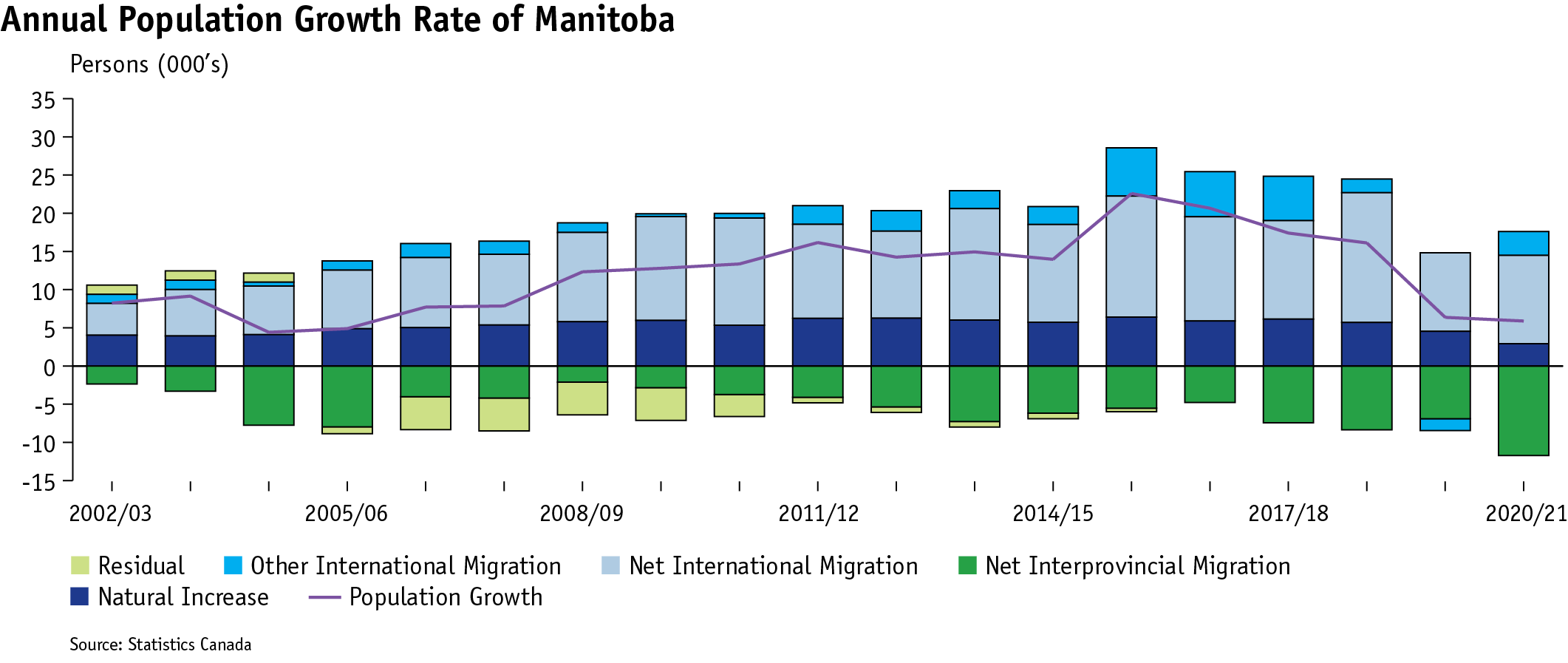

Population

Manitoba has the fifth largest population in Canada at 1,386,333 persons (October 1, 2021), representing roughly 3.6 per cent of the national population.

Manitoba has a relatively young population with a median age of 37.8 years – the lowest median age among provinces. Manitoba’s younger population will create an ongoing supply of labour for the province in the coming years that should help to minimize emerging shortages.

Since the inception of Manitoba’s Provincial Nominee Program (MPNP) in 1999, immigration contributed an increasing number of new residents to the province. However, on March 18, 2020 the Government of Canada implemented travel restrictions aimed at reducing the spread of COVID-19. In addition, the implementation of COVID-19 related health and safety measures within Government of Canada offices impacted processing times for immigration applications and temporary resident permits.

The pandemic has had an unprecedented effect on population growth and immigration levels. Between October 1, 2020 and October 1, 2021, Manitoba’s population increased by 5,886 persons – well below the ten-year average of 15,579 persons per year. During the same period, Manitoba gained 12,636 immigrants – a 17.0 per cent decrease compared to the average for the 2015/16 to 2019/20 period.

With fewer COVID-19 restrictions in effect, Manitoba is seeing immigration levels slowly recover. In 2020/21, Manitoba’s net international migration rebounded by 12.4 per cent compared to the previous year. Furthermore, the provincial nominee program approved the largest number of nominations to date – a record 6,275 applications.

The Manitoba government is currently working with the federal government to renew the existing immigration agreement to help achieve national immigration targets and meet the needs of the province beyond the pandemic.

Economic Recovery Dashboard

For up to date data on indicators that are included in the fiscal and economic updates, visit: Province of Manitoba | Economic Recovery Dashboard (gov.mb.ca)